What Is Structuring In Money LaunderingAnd Tips To Avoid It

Money laundering is one of the most serious financial crimes that can be highly complex to identify.

As a result, financial institutions face challenges in combating fraudsters who justify any means to bypass the anti-money laundering (AML) legislation through a practice known as “structuring”.

In order to prevent money laundering from crippling your business, let’s understand:

- What is the money laundering technique of structuring?

- What are the differences between structuring and smurfing?

- What are the red flags for structuring in money laundering?

Let’s get started.

What is structuring in money laundering?

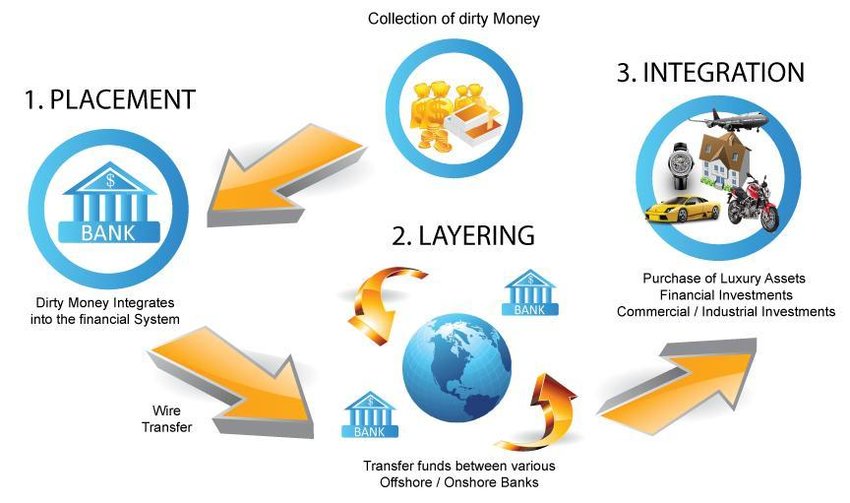

Structuring is also known as the “layering” stage in money laundering, which is the second step after “placement” or the disposition of illicit funds into the financial system.

Source: Research Gate

Structuring is a highly complicated process as criminals need to split up a large financial transaction into a series of smaller transactions.

So, what exactly qualifies as structuring? Here are some examples of structuring:

- Lowering the amount of each transaction below the requirements set by the government

- Transferring laundered money between multiple bank accounts in jurisdictions with weak anti-money laundering compliance

- Transferring a sequence of funds in small amounts on different days

- Using digital currencies, including Non-Refundable Token (NFT) and crypto-currencies, to break off the audit trail

- Disguising transfers by combining digital and traditional transactions

- Purchasing dubious investments or shell corporations through a series of accounts

- Evading taxation and reporting requirements

All of these are done to confuse the law enforcement when tracing the origin of the funds and evade the AML or counter-terrorism financing (CTF) reporting requirements.

Authorities have been actively using advanced technologies, including AI, to flag any suspicious transaction in the system and report it as a warning to get a further check.

This way, cases of structuring can be minimized and the stability of the financial system can be well-maintained.

What are the red flags of structuring?

Businesses might not think that money laundering is a threat to their livelihood.

However, if the whole financial system is crippled, your business will have a hard time surviving inflation, higher capital, less funding, and a myriad of other challenges.

That’s why, both businesses and financial institutions need to work hand-in-hand in preventing money laundering.

An evaluation that needs to be performed is known as enhanced customer due diligence (EDD), ideally by your compliance or legal teams.

Henceforth, training them in indicating money laundering red flags will be crucial, which you can do with the help of an expert AML consultant such as Demire.

For starters, here are some signs to look out for when spotting money laundering red flags:

The nature of the transaction

There could be a couple of aspects wrong with a transaction. If any of the following occurs, make sure to report it for money laundering evaluation:

- If you see an individual depositing multiple amounts, each under USD 10,000 or the equivalent, across a series of days

- If you find the total amount deposited through small daily transactions surpass the maximum limit

- If you spot multiple cash deliberately deposited in a single day across ATMs, branches, or crypto ATMs

- If you find individuals with similar addresses, devices, or nationalities opening accounts nearly within the same time

- If you see customers giving ambiguous, improbable, or inconsistent reasons for opening accounts or depositing funds.

Submission of currency transaction reports

Some countries, such as the United States, mandate a currency transaction report (CTR) for any cash transaction above 10,000 USD, based on the Bank Secrecy Act.

Through the currency transaction report, the bank typically verifies the identity of the individual who intends to conduct large transactions, such as by checking their social security number or transaction history.

This is done even when the person does not have a registered bank account. Although, criminals will typically start a bank account to streamline multiple small transactions.

If a bank finds that a customer initiates a transaction of more than USD 10,000, the bank will automatically require the person to fill in an electronic tax report and ask for their information.

A bank usually will not inform the customer of the USD 10,000 reporting threshold, except if the customer asks. Once informed, customers can choose if they will abort the transaction or proceed with smaller amounts.

If the customer decides to cancel the transaction, they need to fill out a suspicious activity report (SAR).

However, it is important to note that money launderers will avoid any sort of reporting.

So, if you find a corporation that deposits a significant sum of money in smaller amounts and rarely submits a CTR, make sure to do a thorough evaluation.

Suspicious activity report (SAR)

When a customer avoids reporting requirements, they are obliged to file a SAR, not only for the speculation of structuring but other financial crime activities.

This report will then be submitted to the Financial Crimes Enforcement Network (FinCEN) which will be in charge of the investigation.

According to FinCEN, there are five critical components that should be evaluated:

- The individual or entity involved in the suspicious conduct

- The methods, schemes, or tools used in the activity

- The time and location of the suspicious activity

- The reasons for the institution’s suspicion of the activity

The financial institution has to report the incident within 30 days, which can extend to 60 days if more evidence needs to be gathered.

The customer does not have to be informed of the progression of the case.

Conclusion

In closing, the fight against structuring in money laundering is critical for safeguarding your business and the broader financial ecosystem. Complaer stands at the forefront of this battle, offering a streamlined, effective approach to AML compliance. With its innovative No-Code Real-Time Rule Engine, Complaer simplifies the complexity of monitoring and managing transactions, making it easier for businesses of all sizes to stay compliant and secure.

Complaer is not just another tool; it’s a comprehensive platform that empowers your business to preemptively identify and mitigate the risks of structuring. With Complaer, you’re not just defending your business; you’re ensuring its integrity and future growth in an increasingly complex financial world.

You might be interested in