What Is A Shell Company In Money Laundering?Understanding The Red Flags

A shell company often serves as a vehicle to launder money for businesses or conduct other illicit activities.

At times, it is hard to identify shell companies as they might still engage in legitimate commercial uses, covering up their illegitimate dealings.

This low transparency causes a huge vulnerability in the domestic and international financial systems. According to Moody’s Analytics, a total of USD 1.6 trillion is laundered annually.

Therefore, it is important to equip your businesses with the tools to better investigate financial fraud, which is the goal of this article.

You’ll find the definition of a shell company, and best practices to identify one.

What is a shell company in money laundering?

A shell company is a corporate entity without any active business operation or substantial asset.

These companies aren’t inherently illegal, but can potentially be used for illegitimate purposes. That’s why they are considered a threat to the entire financial system.

Frequently, they are established as vehicles for fundraising, business takeovers, and initial public offerings.

Shell companies are usually employed by large corporations, private individuals, or even startups to gain funding. However, they are also often used for questionable dealings.

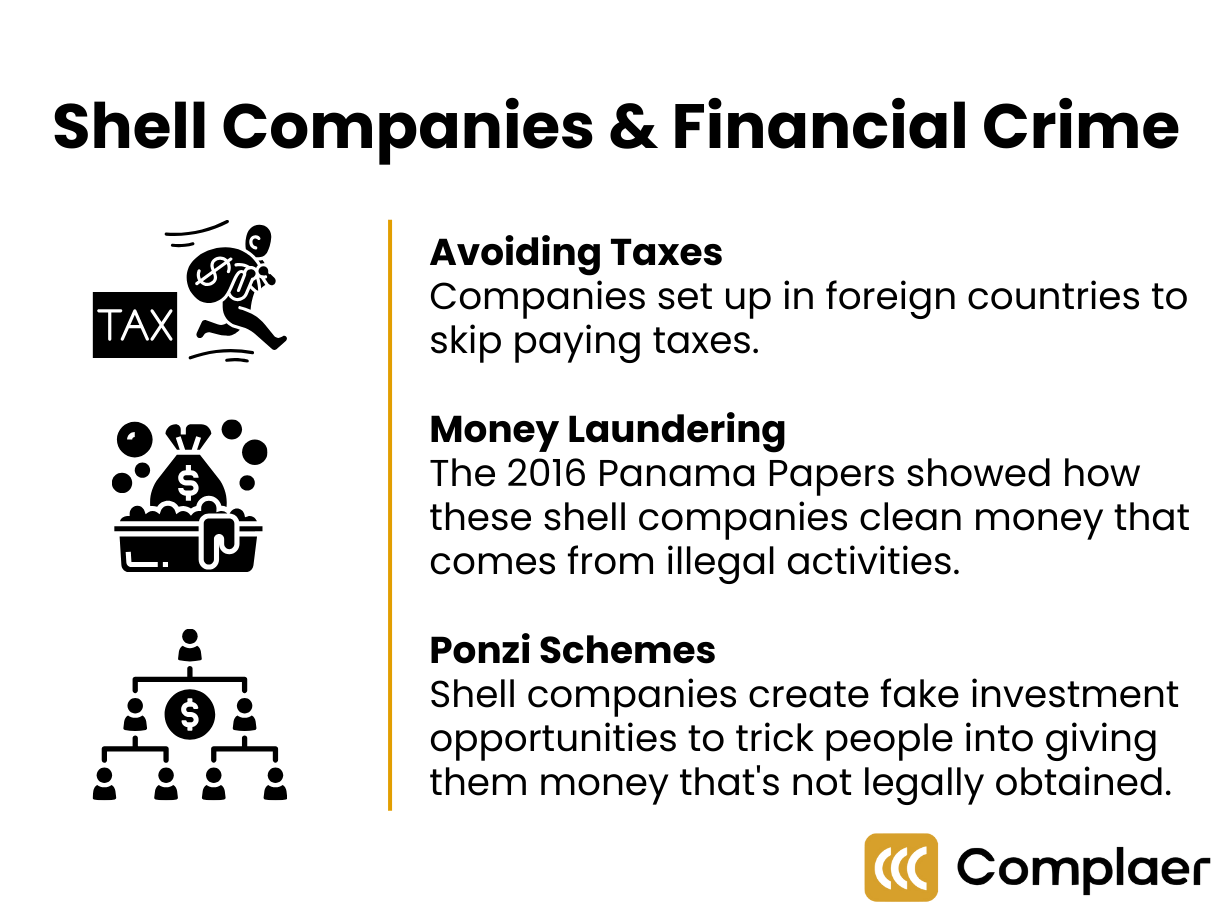

An example of an illegal shell company use is most commonly done for tax avoidance. For instance, Apple’s branch in the United Kingdom is structured to minimize tax liabilities.

Shell companies are also often used for closing financial deals in both domestic or cross-border transactions.

Aside from a mailing address, employment, and economic activities, shell companies often lack physical presence. As a result, they often raise suspicion.

Even if the shell companies are publicly traded, they are still susceptible to illegal activities due to the lack of transparency in ownership if they are privately held.

Such entities are often used in reverse acquisitions or mergers. Fraudulent schemes such as “pump and dump” might occur, which refer to the practice of inflating the value of a private company to deceive investors.

What is the purpose of a shell company?

To truly understand “how do I identify a shell company”? It is important to understand what they are specifically purposed for.

Here are the objectives of a shell company:

- Tax evasion. Corporations may decide to set up jobs and profits offshore to realize a tax haven abroad, where the tax codes are usually looser for foreign businesses. This procedure is also known as “offshoring” or “outsourcing”, which was previously done often domestically.

- International activity. Not only can the companies realize tax savings, they can also conduct financial activities, allowing them to invest in capital markets outside of domestic borders.

- Credit card bust out. This is when an individual, or a “fraudster” who is a member of a shell company, builds up a normal credit line that usually takes months or years.

Then all of a sudden, the individual maxes out the credit limit with zero intention of repaying.

- Purchasing fraud. Companies may buy a “shell company” to move their laundered funds.

- Loan frauds. If a company invests in a shell company, the process will usually involve some misrepresentations or omissions of information to mislead or deceive the lender to provide credits.

- International wire transfers. Shell companies often act as a “middleman” to transfer from the account of a domestic customer to a foreign one, usually in amounts or within a frequency that is inconsistent with the regular nature of the customer’s activities.

How does one set up a shell company?

Shell companies are usually formed by “active agents”. These representatives will go around and assist businesses that require the establishment of shell companies for illicit purposes, then proceed to set them up.

Usually, the agents will choose a jurisdiction with looser regulations for tax evasion as well as business initiation and maintenance.

Then, a “nominee director” will be appointed. This will be the name that signifies the ownership of a business, appearing on all official records instead of the actual owner or shareholder.

Such a step is done to preserve anonymity and secrecy in regard to wealth management.

After, the company will continue with the official registration procedures as normal companies will naturally do. They will pay the government fees, submit the paperwork to form an incorporation, and open a bank account.

This is when it might be tricky to prevent the establishment of shell companies, as they may conceal a significant amount of information to deceive the authorities.

Once they are recognized as a legal entity, shell companies will usually do a mix of both legal and illegal activities to avoid getting detected.

Here is a list of legitimate activities that shell companies usually conduct, as other businesses do:

- Own a property or other assets

- Conduct a business such as making investments or receiving income

- Sign contracts or other legal agreements

- Hire employees or contractors.

What Are the Red Flags of Shell Companies?

Here are some indicators as to how individuals or businesses may abuse shell companies for personal gain:

- Nominees who act as formal agents for multiple shell companies

- Informal nominees, such as family members, who aren’t involved in day-to-day operations

- Lack of actual business activities. Oftentimes, they’re limited to quick transit transactions

- Minimal staffing with an absence of tax and social security contributions

- No physical presence

- Customers regarded as both senders and recipients in multiple international wire transfers

- Repetitive transactions without clear business purposes or involving family members without legitimate reasons

Conclusion

Understanding the mechanics and potential red flags of shell companies is crucial in the fight against money laundering. Shell companies, while legal entities, can often mask illicit activities under the guise of legitimate operations, making them a significant tool for money launderers.

Complaer’s RegTech SaaS platform represents a powerful ally in this effort, offering an array of features designed specifically for AML professionals. By automating over 60% of compliance workflows and integrating comprehensive AML/CTF functions, Complaer not only enhances the efficiency of compliance teams but also significantly reduces the risk of overlooking or failing to act upon the subtle signs of money laundering. Equipped with real-time transaction monitoring, screening, and risk assessment capabilities, along with a user-centric No-Code Rule Engine, businesses can stay ahead of potential threats.

Complaer’s scalable solution ensures that as your business grows, your capacity to detect and respond to suspicious activities does too, safeguarding your operations and the financial system at large from the dangers posed by shell companies and money laundering activities.

You might be interested in