Unmasking The Smurfing:How This Money Laundering Trick Works And Why It Is Harmful

Introduction

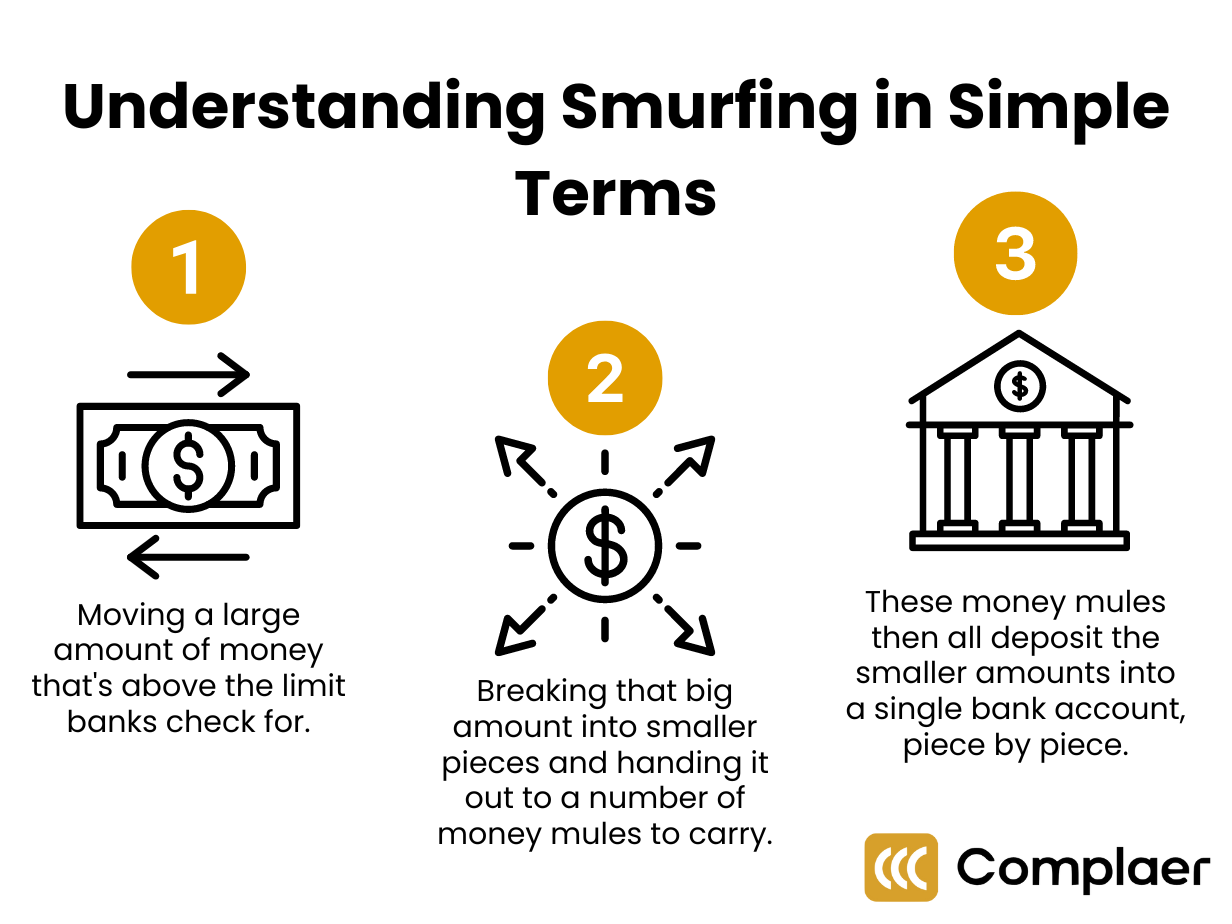

Smurfing is a sneaky tactic employed by money launderers to evade detection. It involves breaking down large sums of illegal funds into smaller, less suspicious transactions, often below reporting thresholds.

Smurfing is popular because of its simplicity and apparent innocence. Who questions someone who makes a few tiny deposits?

For companies and financial institutions, understanding smurfing is crucial in preventing their systems from being used for illegal activities.

By educating yourself and those around you about smurfing, you can help protect your company and the financial system from the damaging effects of money laundering.

This article will give you a better understanding about what is smurfing in money laundering and why it is harmful.

What is smurfing in money laundering?

Smurfing in money laundering is a tactic employed by money launderers, involving breaking down large sums of illegal funds into smaller, less conspicuous transactions.

This trick aims to evade detection by financial institutions and authorities, allowing the laundered money to seamlessly integrate into the legitimate financial system.

The term “smurfing” was generated by the small figures in the Smurfs animation. It aptly represents the process of dividing a large sum into numerous, seemingly little amounts, echoing the enormous number of identical Smurfs.

While the exact origin remains unclear, some speculate it emerged within the language of drug traffickers, who often purchased small quantities of substances or ingredients from multiple sources to assemble their final product.

What are the differences between smurfing and structuring?

Smurfing and structuring are both money laundering tactics, but their intentions and implementation differ.

Structuring specifically targets bank deposits. It involves intentionally dividing large sums into smaller transactions below reporting thresholds. Usually, the launderer will create multiple accounts to avoid suspicious activity reports (SAR).

Cuckoo smurfing

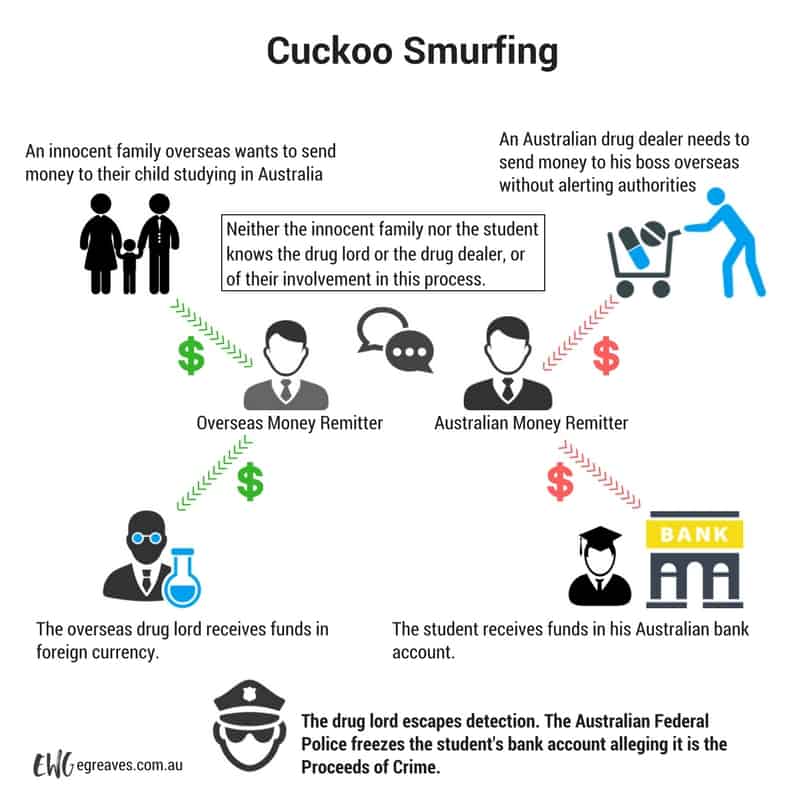

Cuckoo smurfing is a cunning money laundering technique where criminals exploit the bank accounts of unsuspecting individuals to disguise and move illicit funds. It’s like a “cuckoo” bird laying its eggs in another bird’s nest, except instead of eggs, it’s dirty money.

Source: https://egreaves.com.au/cuckoo-smurfing

They identify individuals expecting legitimate funds, like students receiving overseas payments or online sellers. Instead of sending real money, criminals pose as a legitimate source and promise a larger transfer.

The victim then receives instructions to deposit smaller amounts, usually below reporting thresholds into accounts controlled by the criminals. Simultaneously, the criminals transfer an equivalent amount to their desired location, using different channels and accounts.

The victim believes they are receiving the promised funds, unknowingly assisting in laundering illegal money.

Here’s a scenario to help you understand it better:

Imagine John, a student expecting a $5,000 tuition payment from his parents abroad. A “buyer” contacts John, offering to pay $7,000 for a product he doesn’t own.

The “buyer” instructs John to deposit $2,000 each into 3 different accounts, claiming it’s faster and cheaper.

Meanwhile, the “buyer” sends $5,000 to their accomplice in another country. John receives nothing, while the criminals launder $2,000 and pocket $2,000 profit.

Why do money launderers smurf?

Before going further into smurfing, here are the stages of money laundering that you should take note of:

1.Placement:

This stage involves introducing the illegal funds into the financial system. Criminals need to get their dirty money into banks or other financial institutions. This is where cuckoo smurfing comes in. By splitting the money and depositing it into unsuspecting individuals’ accounts, they avoid detection and reporting thresholds.

2.Layering:

At this stage, the goal is to distance the funds from their illicit origins. This involves complex financial transactions like using shell companies, offshore accounts, or international transfers. Cuckoo smurfing typically doesn’t play a role here as the focus is on moving the money further away from its original source.

3.Integration:

Now, the laundered money is reintroduced into the legitimate economy. This could involve buying assets, investing in businesses, or simply using the “clean” money for everyday expenses. Again, cuckoo smurfing is not usually involved here as the money has already been “washed” clean.

So, why do they smurf?

Many financial institutions report transactions exceeding a certain amount. In Lithuania, transactions exceeding €15,000 in cash or equivalent must be reported to the Financial Intelligence Unit. Splitting the money avoids triggering these reports.

By using others’ accounts, criminals hide their identity and the source of the funds.

Why is smurfing harmful?

The victims of smurfing, in some cases, don’t realize they are involved in such severe crime. This can be avoided with some preventions, such as:

Be wary of unsolicited offers: If someone proposes an easy way to make money involving money transfers, be skeptical and decline.

Understand transaction sources: Be cautious of receiving large deposits from unknown individuals or businesses.

Report suspicious activity: If you suspect your account is being used for money laundering, report it immediately to your bank and authorities.

While knowing how to evade being smurf is important, understanding its harms also allow you to illustrate how damaging it is.

Unknowingly participating in money laundering is a crime, potentially leading to hefty fines, jail time, and a criminal record.

Banks may also freeze or close accounts associated with suspicious activity, causing financial hardship and difficulty accessing funds.

Being linked to money laundering can also severely damage personal and professional reputations, making it difficult to find employment, rent housing, or secure loans.

Not to mention criminals might threaten or harm smurfs to ensure their cooperation or silence.

Conclusion

Smurfing is part of money laundering, involving the funds distribution into smaller amounts to avoid being detected as suspicious activity.

Being wary of easy money offers and understanding how money laundering works will help you from falling into financial crime.

If you’re still not sure how to avoid smurfing, using an AML/CTF RegTech solution like Complaer can do the trick.

It comes with everything you need to identify and stop any kinds of illegal financial practices, including real-time transaction monitoring and screening, advanced customer due diligence, and Complaer’s no-code real time rule engine.

You might be interested in