Setting New AML Transaction Monitoring Standards

Our Compliance team believe that real-time transaction monitoring is crucial in Anti-Money Laundering (AML) and compliance efforts. The Complaer SaaS platform provides a variety of methods and approaches to focus on the prevention of financial crimes without sacrifying the system performance. Timely detection of suspicious activity allows for more accurate identification of illicit activities and reduction of an AML team workload.

The cost to resolve an AML incident found during retroactive (retrospective) transaction monitoring is about ten times higher than one identified during real-time transaction monitoring and the transaction is blocked. The total cost of client communication and risk level adjustment for the transaction was already processed is then four to five times more, and up to 100 times more than one identified during the compliance audit. In other words, the cost of an AML incident grows exponentially. Real-time transaction monitoring is essential for proactively identifying and addressing potential threats, meeting regulatory obligations, and safeguarding the financial system against illicit activities. It is a foundational component of a robust AML and compliance program

Timely Detection

and Prevention:

and Prevention:

Complaer real-time monitoring allows regulated companies to detect potentially suspicious transactions as they occur. This immediacy is essential for identifying and responding to activities that may be indicative of money laundering or other illicit financial behavior. By monitoring transactions in real-time, financial institutions can take swift action to prevent and disrupt financial crimes, including money laundering, terrorist financing, and fraud. Early intervention helps mitigate the impact of such activities and protects both the institution and its customers.

Real-Time Immediate Response and Retrospective Analysis:

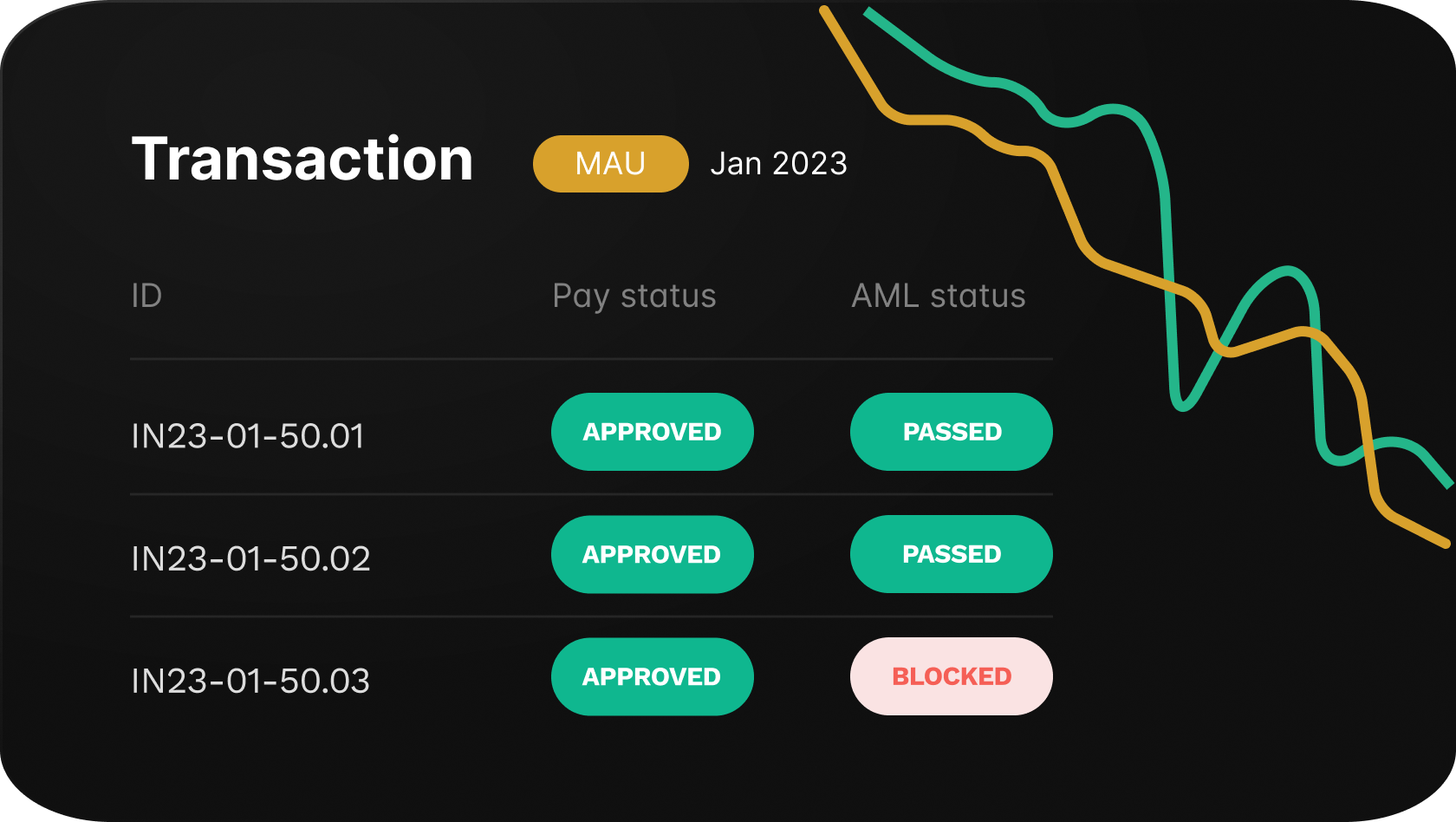

When suspicious activity is identified in real-time, regulated companies can take immediate action to investigate, report, and remediate the situation. Complaer’s Transaction Monitoring Module ensures proactive response for minimizing the impact of financial crimes and protecting the institution's integrity and reputation. Criminals continually evolve their tactics for money laundering. Real-time monitoring enables financial institutions to adapt quickly to new and sophisticated methods, however, this would not be possible without deep retrospective monitoring. Retrospective analysis allows organizations to analyze historical transaction data to identify patterns or trends that may not have been apparent in real-time. This is valuable for recognizing subtle or evolving patterns of suspicious behavior.

Retro Risk Management and Reduction of False Positives:

Our SaaS Platform retrospective transaction monitoring supports a risk-based approach to AML, where higher-risk transactions or customers receive increased scrutiny. This approach enables companies to be compliant to allocate resources more efficiently and focus on areas with the greatest potential for financial crime. The ability to conduct a thorough historical analysis provides a more comprehensive view of customer behavior and transaction patterns over an extended period. This is beneficial for understanding long-term trends and anomalies. Retroactive monitoring aids investigators in analyzing past incidents or transactions. It provides a detailed historical context that can be crucial for forensic analysis and supporting investigations into financial crimes.

Real or Retro?

Compliance with Regulatory Requirements

Regulatory authorities often require regulated companies to implement robust AML programs, including real-time transaction monitoring. Meeting these regulatory requirements is essential for avoiding fines, penalties, and reputational damage. Real-time monitoring is designed for immediate detection and intervention, while retroactive monitoring involves a retrospective analysis of historical data

Legitimate Customer Protection

Real-time monitoring helps protect legitimate customers by preventing unauthorized transactions and identity theft. Timely detection and response contribute to a safer financial environment for all customers. Complaer’s real-time monitoring module can be integrated with other risk management and compliance tools, creating a holistic approach to safeguarding against financial crimes ensures each client transaction Sanctions, PEP and Adverse Media screening

Where Flexibility Meets AML Expertise

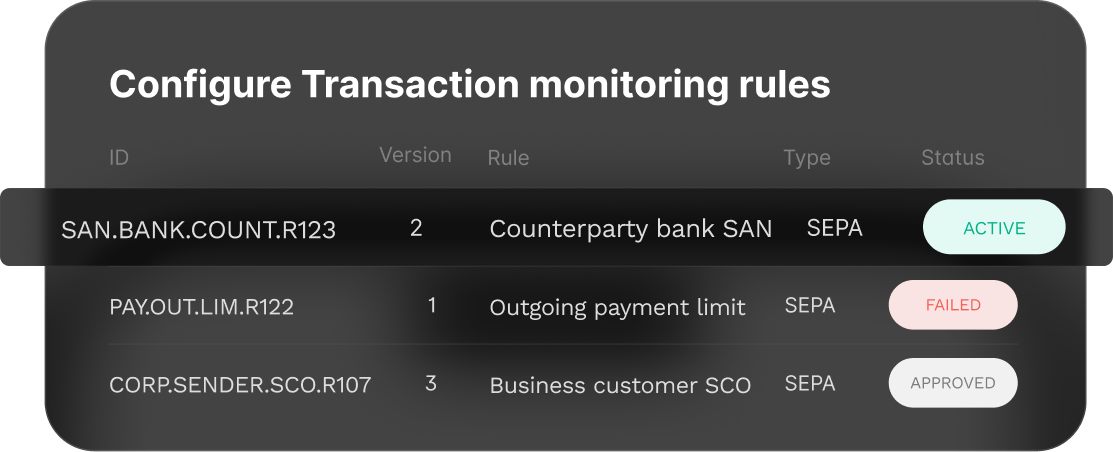

The main difference between real-time and retroactive (or retrospective) transaction monitoring lies in the timing of the analysis and response to financial transactions. Both Real-time and Retrospective monitoring, when coupled with CaaS advanced analytics and technology-driven SaaS solutions, allows for more accurate detection of suspicious activities. The Complaer system unique design and architecture allow to shift AML policy focus between real-time and retro monitoring with an ease. Analyzing historical data helps in calibrating and improving the effectiveness of predictive models used in transaction monitoring systems. Quick AML rules setup allows organizations to refine their algorithms based on actual historical outcomes, moving forward the most important rules to the real-time monitoring

How it works

in Complaer

in Complaer

In many cases, a comprehensive financial monitoring strategy may involve a combination of both real-time and retroactive approaches. Real-time monitoring is crucial for immediate threat detection, while retroactive monitoring provides a more comprehensive understanding of historical transaction patterns and helps improve overall detection capabilities over time

Join businesses that trust Complaer for unmatched compliance. Request a demo and

experience the future of real-time AML

transaction monitoring