Money Laundering:What It Is and Understanding the Three Stages

Introduction

Money laundering is one of the most alarming financial crimes, involving the concealment of illicitly obtained funds to make them seem legitimate.

This criminal practice is commonly done in illegal activities such as narcotics, arms sales, human trafficking, and fraud.

The United Nations Office on Drugs and Crime (UNODC) reports that money laundering costs 2-5% of the global GDP or equal to $2 trillion.

Understanding the threats of money laundering will help you devise the right protective measures for your organization.

However, many companies still need to figure out how to educate their employees in combating crime.

That’s why, this article will dive deep into what money laundering is, and the three stages of such practice.

What is Money Laundering?

Money laundering is the illegal process of disguising large amounts of money from criminal activities, namely drug trafficking, terrorism, corruption, and gambling, to appear “clean”.

Here is also an excerpt from UN Vienna 1998 Convention Article 3.1 on the definition of money laundering:

“The conversion or transfer of property, knowing that such property is derived from any offense(s), to conceal or disguise the illicit origin of the property or of assisting any person who is involved in such offense(s) to evade the legal consequences of his actions.”

More often than not, money laundering happens in the white-collar environment compared to the street level.

Internationally, especially in Lithuania, money laundering is a significant issue.

To counteract this, the government and financial institutions have implemented anti-money laundering (AML) policies, which follow a checklist for companies and organizations to identify, report, and prevent potential money laundering cases.

Money laundering poses a significant evasion toward financial institutions on a regional and global level, negatively impacting exchange and interest rates.

With rising inflation and unemployment, it will be hard for businesses to survive in an unstable macroeconomic climate and can even lead to mass shutdowns.

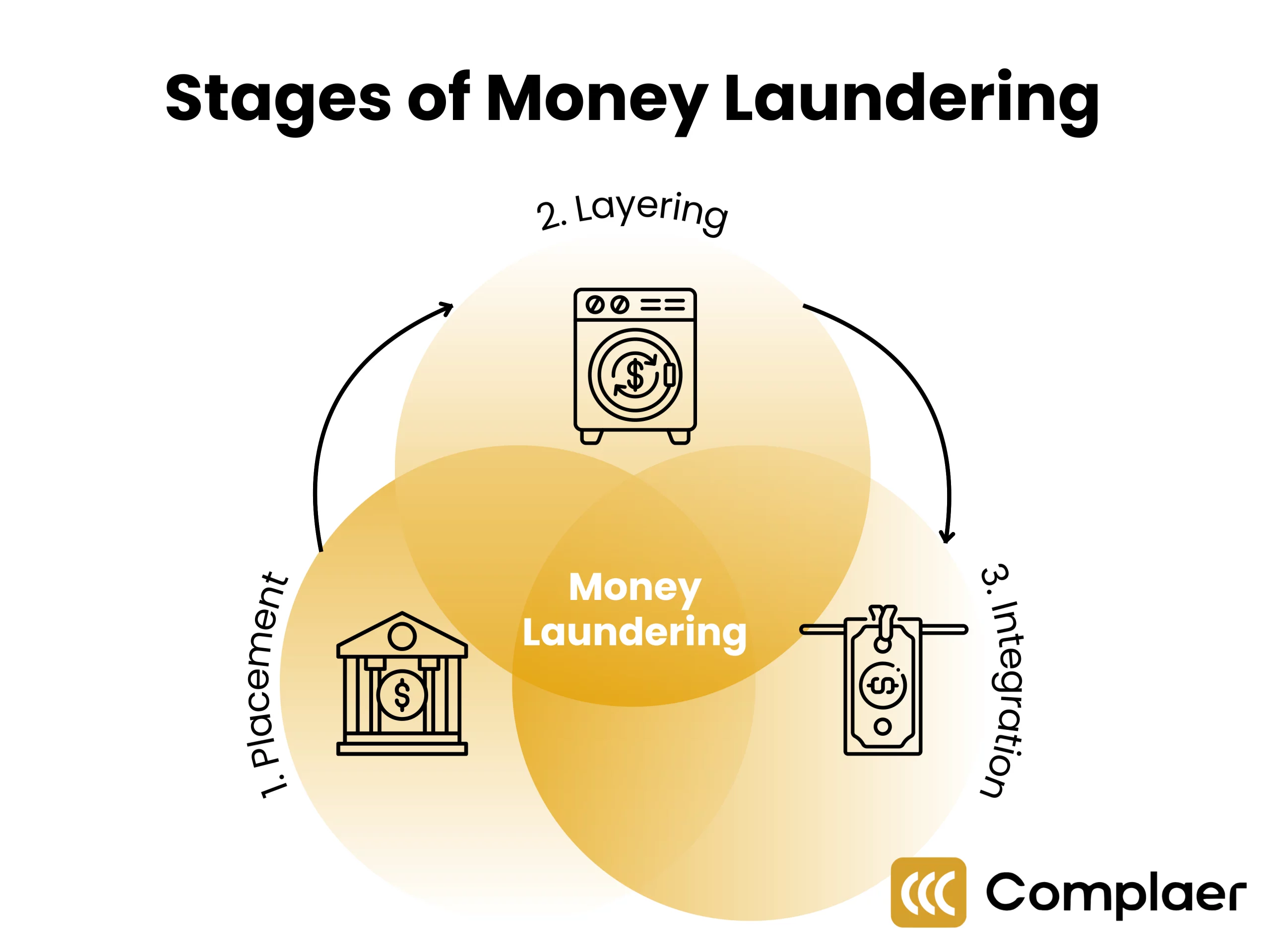

Three Stages of Money Laundering

Money laundering is a highly complex organized crime as it involves multiple crime actors and even institutions.

This financial crime can be avoided if organizations follow AML compliance which include three essential stages to identify money laundering:

1. Placement

Placement, as the name implies, is the starting point of money laundering when dirty money is placed into the financial system.

This step is the most vulnerable as criminals need to deposit a large sum of money into an offshore foreign bank account without raising suspicion.

During this part, the money is “washed” or “cleaned” to give the impression of a legitimate transaction. Here’s how criminals usually operate:

- Under-invoice or over-invoice the entity

- Falsify the description of goods and services

- Document false or phantom shipping, where no product is shipped

- Deposit the cash by chunking them into smaller amounts to avoid detection or “structuring”

- Utilize money orders, checks, and other monetary instruments

- Funnel the money to dubious business schemes such as car washes and casinos

2. Layering

So, what exactly is layering in money laundering?

In short, this situation happens when criminals conduct a series of transactions to create a distraction and further distance the funds from the criminal origin.

The money laundering criminals usually falsify the audit trail for anti-money laundering authorities through fraudulent bookkeeping and layering financial transactions.

Layering financial transactions is usually done through the following activities:

- Transferring money between multiple bank accounts in different jurisdictions, usually the ones that lack AML compliance

- Using digital currencies such as Non-Refundable Token (NFT), bitcoins, or cryptocurrencies to obscure the audit trail

- Combining digital with traditional transactions to disguise transfers

- Purchasing investments or a shell corporation through a series of accounts globally

- Transferring deposits of fiat currency from one bank, usually through cryptocurrency, to a different account or bank

Due to these “layers”, it will be extremely difficult for law enforcement to trace the source of origin funds.

3. Integration

The final stage of money laundering which is also the most crucial one.

In this stage, the laundered money, which has successfully passed the initial layering stage, has entered the legal financial system and appears as if it’s a legitimate fund.

Integration often occurs through transactions within legal financial systems, namely real estate, luxury assets, or business ventures. This is done to provide a credible reason for the origin of the money.

Criminals also commonly inflate the value of goods on an invoice, be it from an import or an export, to extract ‘clean’ money.

If the money has reached this point, it has officially become a legal tender for criminals, thereby making it difficult to differentiate illegal and legal funds.

If an integration is deemed successful, criminals will use the laundered money to proceed with their illegal activities or personal enrichment without worrying about getting detected, even for anti-money laundering authorities.

This is because no documentation or physical evidence has been found to link the funds to the previous layering and placement phases.

The integration phase is highly complex yet subtle, and the role of anti-money laundering controls and vigilant monitoring has become more irreplaceable than ever, especially in any organization.

Conclusion

Money laundering should be avoided at all costs as it can severely damage not only businesses but the global financial institutions.

Aside from following the three stages to detect money laundering, there are other actionable tips we can do:

- Rigorous training. Conduct practical training and educational sessions to help your employees become aware of the signals of money laundering and how to take action.

- Technical approach. Implement data analytics to identify the patterns of money laundering and automation to flag suspicious transactions and warn the entire team.

- Due diligence. Reduce risks by establishing comprehensive AML regulations that apply to customers, associates, consultants, and third-parties.

You might be interested in