Empowering Industries with Complaer's Innovative Solutions

Join the ever-growing list of businesses that have harnessed the power of our innovative approach. Complaer's industry use cases exemplify the transformative impact we've had on organizations within your sector. With Complaer, you can unleash the full potential of your data, gaining valuable insights that drive unparalleled success

Why Choose Complaer for Your Industry?

Adaptable

Our solutions are flexible and adaptable to any regulated business model. Whether you operate in the financial sector or real estate, Complaer is here to support your compliance needs

Easy Integration

We've designed our solution for quick and seamless integration, ensuring a smooth transition like any other third-party service provider. Our technical team is always ready to provide maximum support

Proven and Tested

Backed by a team of former regulators and seasoned IT professionals, we offer verified solutions. Rest assured, they work flawlessly

Industry-Specific Solutions

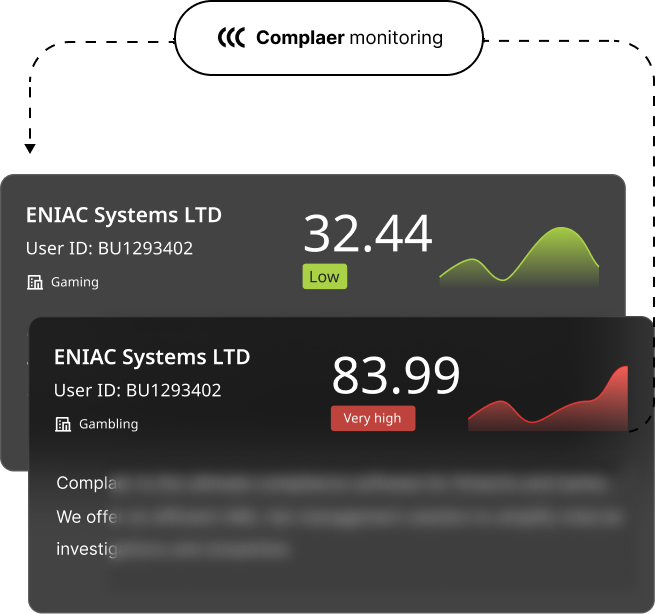

FinTechs & Banks

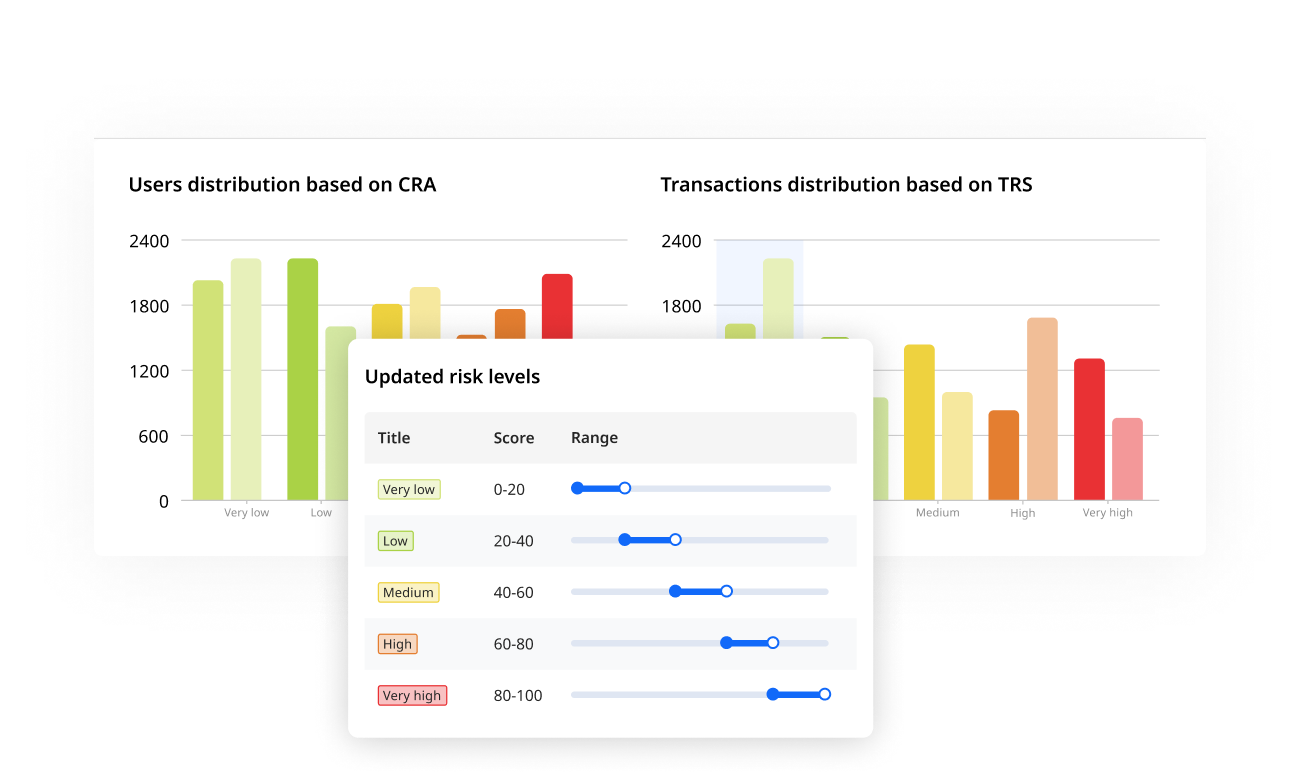

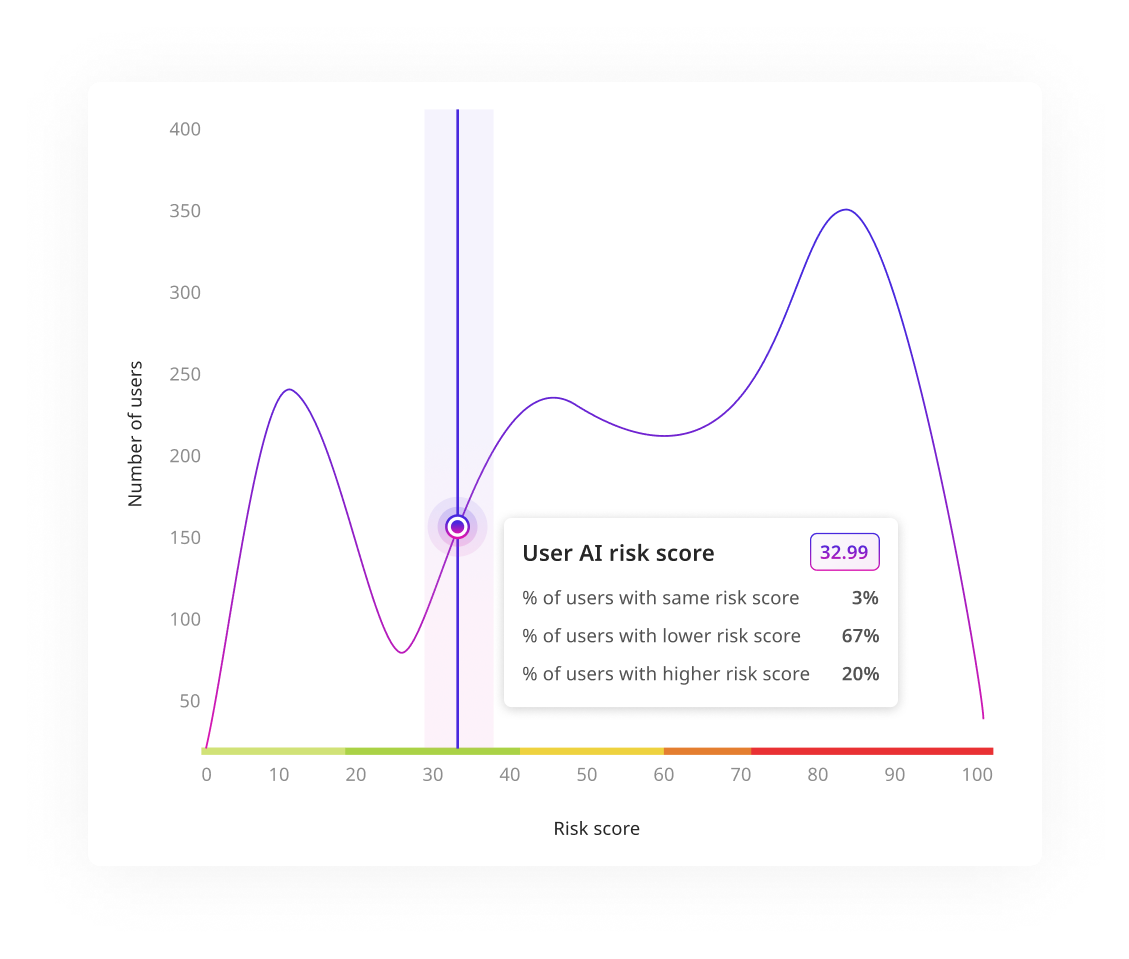

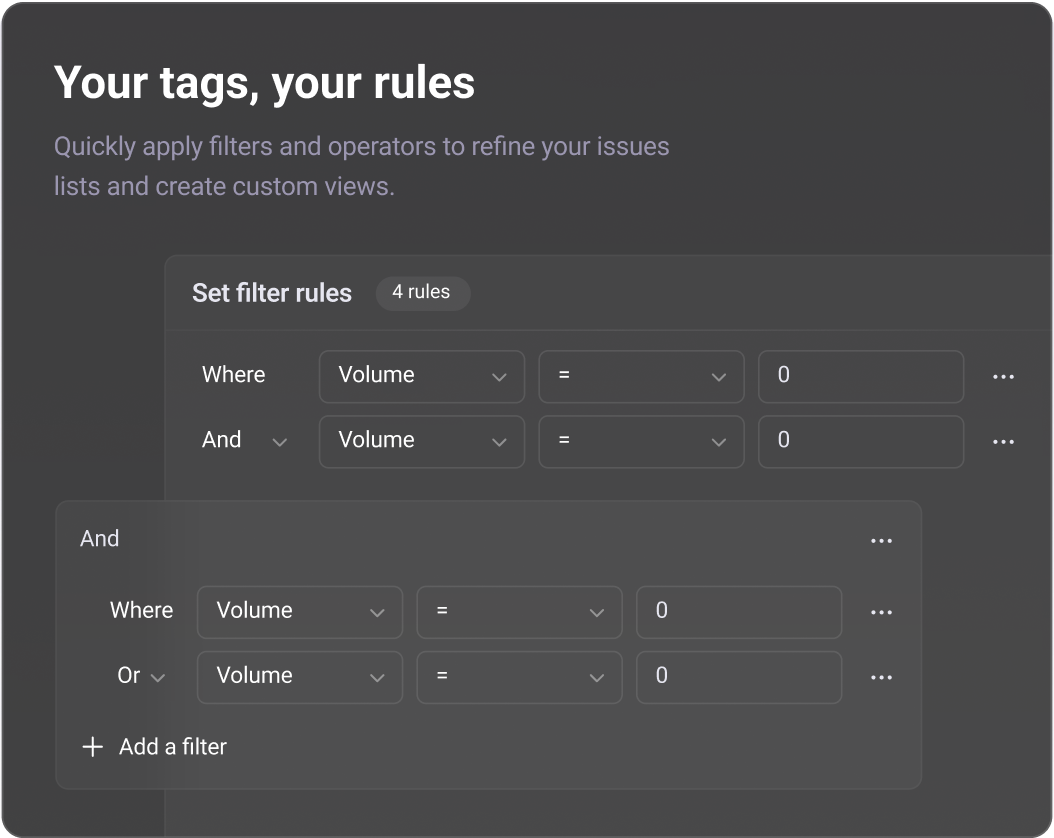

Complaer is the ultimate compliance software for fintechs and banks. We offer an efficient AML risk management solution to simplify internal investigations and streamline STR submissions to your local FIU. Customize your modules, scenario library, and rules to align with your compliance objectives seamlessly

Crypto Businesses

Enhance your blockchain analytics capabilities with Complaer's high-performance crypto and fiat transaction monitoring. Our solution ensures comprehensive AML compliance, allowing you to adapt scenarios to CASP requirements and effortlessly manage all data flows for regulatory reporting

Regulated Entities

If your business falls under any regulatory requirements, Complaer is your ally in achieving full compliance with AML/CFT regulations. Conduct internal investigations effortlessly with fully integrated modules and collect all the necessary data

Banking as a Service Providers

Maintain complete control over your risk appetite and regulatory risk while gaining visibility into your customers' activities. Ensure that both customers and partners consistently meet your AML/CFT standards and regulatory requirements